E-Waste Recycling in India: Expectations vs. Reality

- Biznex SEO

- Sep 11

- 4 min read

Introduction

E-Waste Recycling in India is emerging as a high-potential sector, driven by the rapid increase in electronic consumption, rising awareness of environmental sustainability, and government policies promoting responsible recycling. India stands among the top e-waste-generating countries globally, and while expectations are high, the reality presents both challenges and opportunities for serious recyclers. For those looking to engage professionally, resources like Respose India’s e-waste programs provide actionable frameworks, and their services page offers insights into solutions.

Current Trends in E-Waste Recycling in India

Volume of E-Waste Generation

India’s e-waste generation has been on the rise, from approximately 10.14 lakh metric tones in FY 2019-20 to 17.51 lakh metric tones in FY 2023-24 (TelecomTalk). This growth reflects the increasing penetration of consumer electronics, smartphones, and renewable energy devices across the country.

Graph Placeholder: Line Chart - Year-wise E-Waste Generation (2016–2024)

Processing Capacity

As of 2025, India has 322 registered recyclers with an authorized processing capacity of 22,08,918 MT per year and 72 refurbishes with 92,042 MT per year (Deshsewak.org). Despite this capacity, actual processing lags, showing the untapped potential in the sector.

Formal vs. Informal Recycling

Currently, about 43–50% of generated e-waste is processed through formal channels, with the rest handled by the informal sector. This creates both challenges and opportunities for formal recyclers to expand operations.

Expectations Set by Policy

The E-Waste (Management) Rules, 2022, revised from earlier versions, introduced stricter guidelines under the Extended Producer Responsibility (EPR) framework. Producers are required to meet collection and recycling targets (60% in 2023, rising to 70-80% in subsequent years). These policies aim to enhance collection infrastructure, formalize the informal sector, and promote scientific recycling methods.

Learn more about professional recycling frameworks through Respose India’s e-waste programs.

Why E-Waste Recycling in India Holds Potential

Growing demand for recovered materials such as precious metals and plastics.

Rising compliance and regulatory clarity reduce risk for investors.

Opportunities exist in both urban and semi-urban collection networks.

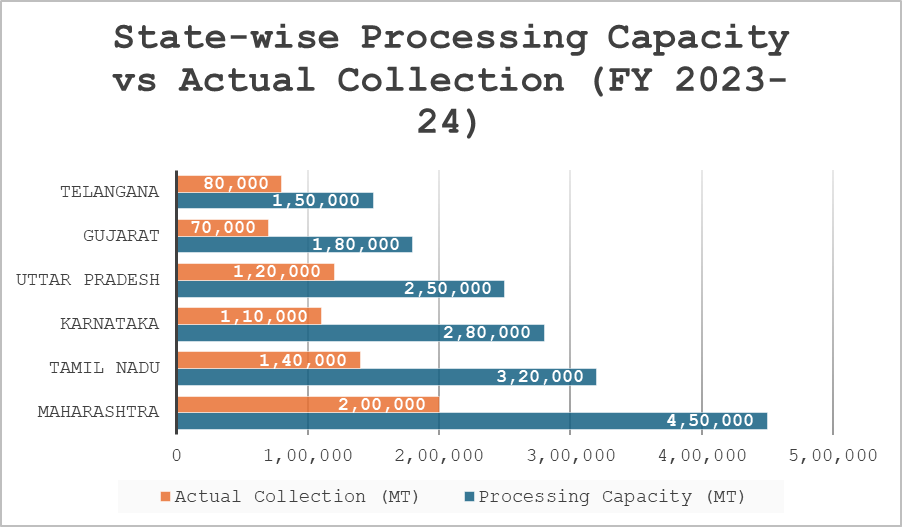

Bar Chart Placeholder: State-wise Processing Capacity vs Actual Collection

Reality of E-Waste Recycling in India Today

Collection & Logistic Gaps

While the capacity exists, logistical challenges limit full utilization. Many consumers are unaware of authorized collection points, and informal channels still dominate in rural areas.

Informal Sector Integration

The informal sector plays a significant role in e-waste handling. Transitioning these players into compliant, formal recycling networks is a key opportunity.

Awareness & Technology Constraints

Producers under EPR sometimes meet targets through certificate trading rather than improving actual collection. Additionally, some recyclers lack advanced technology for extracting critical materials.

Opportunities for Serious Recyclers

Market Size & Financial Upside

The domestic e-recycling sector is projected to reach approximately ₹1,726.33 crore (US$198.52 million) by 2032, growing at a CAGR of 13.5% (IBEF). The financial potential is significant for early entrants and committed recyclers.

Alignment with Policy

Compliance with EPR and registration with CPCB ensures legal credibility and opens doors for partnerships with OEMs and government agencies.

Technology & Innovation

Investing in cutting-edge recycling technologies, including battery recycling, hydrometallurgical recovery, and automated dismantling, enhances both efficiency and profitability.

Geographic Opportunities

Some states outperform others in collection and processing efficiency. Targeting under-served regions offers first-mover advantages.

Case for Strategic Action

Build Robust Collection & Supply Chains

Invest in reverse logistics, consumer awareness campaigns, and corporate partnerships to increase collection rates.

Focus on High-Value Material Recovery

Prioritize recovery of precious metals, rare earths, and critical components. Partner with technology providers for enhanced extraction efficiency.

Operational Efficiency & Scale

Maximize licensed processing capacity through efficient workflow, trained workforce, and cluster-based collection models.

Future Roadmap for E-Waste Recycling in India

Enhance technology adoption and R&D.

Increase collaboration with informal sector players.

Establish centralized hubs or eco-parks for processing and training.

Conclusion

The gap between expectations and reality in E-Waste Recycling in India represents a window of opportunity. With policy support, growing consumer awareness, and technological advancements, serious recyclers can capitalize on a sector poised for exponential growth. By investing in collection, technology, compliance, and partnerships, the future of e-waste recycling in India looks promising.

For businesses exploring professional engagement, Respose India offers structured solutions and frameworks for sustainable growth.

FAQs

Q1. How much e-waste does India generate annually?

A: India generated approximately 17.51 lakh metric tonnes in FY 2023-24 (TelecomTalk).

Q2. What portion is processed formally?

A: Around 43–50% of total e-waste is formally processed (Factly.in).

Q3. What are the EPR targets?

A: 60% collection in 2023, rising to 70–80% in subsequent years for specific EEE categories (The Hindu).

Q4. How can businesses participate?

A: Register with CPCB/EPR, invest in collection, adopt advanced technology, and partner with OEMs and NGOs. See Respose India’s programs for guidance.

Q5. Why is this sector promising?

A: Large untapped collection, rising material value, regulatory clarity, and growing market size make E-Waste Recycling in India a high-potential sector.

(Disclaimer: The figures mentioned in this blog are based on official sources (CPCB, MoEFCC, IBEF, The Hindu, Factly, TelecomTalk, etc.). While care has been taken to reference authentic data, the figures may not be 100% accurate due to year-wise updates, reporting differences, or methodology variations.)

Sources

· CPCB & MoEFCC: Year-wise e-waste generation (Data.gov.in)

· Processing capacity: Deshsewak.org (link)

· EPR rules: The Hindu (link)

· Market projections: IBEF (link)

Comments